Imagine what a line of credit could do for your business.

Draw the funds you need to stock up on inventory , invest in operations , cover payroll , and more.

Credit lines from $250,000

Rates as low as 4.8%1

Approvals as fast as 20 minutes

Benefits

Fast Approvals

Apply online in minutes

Same-day cash with wire transfer option2

Funds on Demand

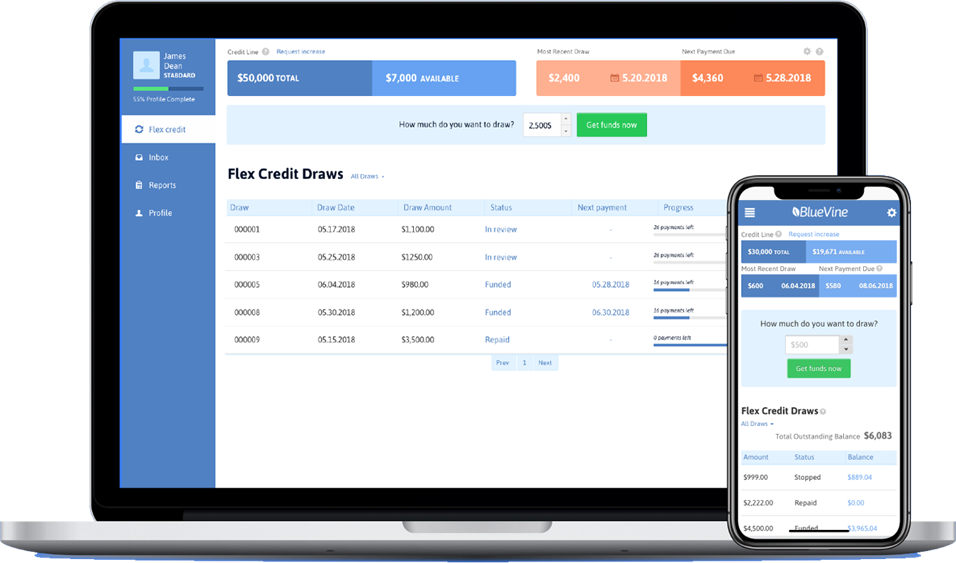

Draw funds up to your credit line with a click of a button

Available credit replenishes as you pay

Transparent Fees

Only pay for what you use

No prepayment fees, pay off anytime

How it Works

Step1

Apply and get a decision within 20 minutes

Step2

Use our online dashboard to request funds

Step3

Pay back each draw with fixed weekly or monthly payments

Step4

As you pay off your balance, your credit replenishes

- The rate is a simple interest rate calculated from total repayments over 26 weeks.

- Once approved, get funds deposited in your bank account in as quickly as a few hours if you choose our bank wire option ($15). Or, choose our free ACH transfer option which typically gets funds deposited the next business day, although it may take up to three.

- For businesses organized as a limited liability company or corporation, we do not perform a hard credit pull at any point in our process, which means your credit score will not be impacted. For businesses organized as sole proprietors or general partnerships, we will only perform a hard credit pull after you receive and accept your offer.

Minimum qualifications

- 600+ FICO

- 6+ months in business

- $100,000 in revenue

What you need to apply

- Basic details about you and your business

- 6Bank connection or 3 months most recent bank statements